Maximise your Fuel Tax Credits

With access to a database of off–road locations in Australia, we can help you uncover the full amount of fuel consumed off road. This will help you to claim back the higher rate of 41.6 cents for private road usage.

Idling engines

Easily identify total engine idling across your fleet to maximise your FTC claim, supported by verifiable engine data reporting.

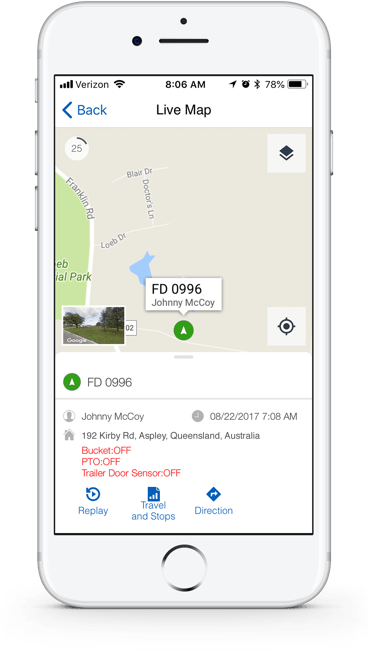

Equipment & machinery

Track and claim on fuel used for stationary equipment and machinery for auxiliary motors. Our GPS-verified reporting can show both location and engine hours.

Track all off-road locations

Off-road claims can be more than just dirt roads. Off-road can include warehouses, distribution centres, shipping ports, airports, carparks, farms, mines, forests and beaches.

Claim back up to four years

You can go back up to four years on historical BAS returns to claim additional fuel tax credits based on the evidence provided by our fuel tax software, for litres consumed on private roads that were previously submitted as public roads.

Get a demo

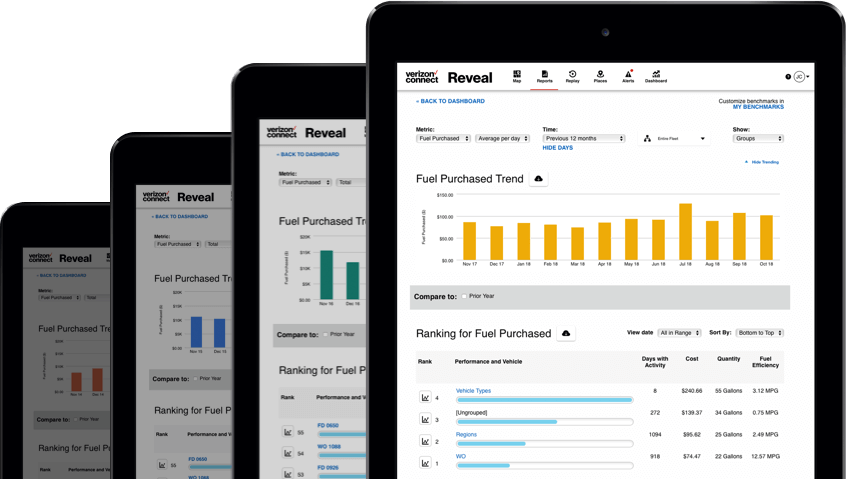

Automated Solution

Get a solution that combines everything you need to maximise, automate and confidently submit FTC returns – GPS location, route history, engine hours, idling, vehicle type, claim rate and off-road location database.

Get a free demo

Within 15 minutes we will show you how our platform can best fit your business objectives.

Features

Driver ID

Each driver gets a unique key fob, required for each journey. Report on vehicle behaviour by assigned driver to isolate training opportunities.

Truck fleet tracking

Supervisors have full visibility on the current location and status of all trucks using back office integration with our fleet management platform.

Flexible hardware

Choose from factory-fitted or aftermarket vehicle GPS hardware, or just use the driver’s mobile device for navigation and compliance reporting.

Truck legal routes

Provide drivers with routes that use STAA-approved roads based on the vehicle’s size, weight and load type e.g. HAZMAT.

Hybrid navigation

Get the convenience of on-board computing (the in-cab navigation device) plus the unlimited power, flexibility and dynamic data of off-board Internet servers.

Data security

Driver IDs, logins and restricted access means customer data is secure, safely backed up in carrier-grade data centers with full reporting options.

Safety view

Safety view provides drivers with helpful information relating to potential hazards such as speed, weather, traffic and terrain.

Real-world map views

Clear vision of complex maneuvers to negotiate interchanges and junctions. Drivers get spoken turn-by-turn directions so they can focus on the road ahead and upcoming intersections.

Custom routing

Modify routes to automatically avoid hazardous areas, while using specific refuelling stations, truck stops, or other POIs, and comply with customer access requirements.

Traffic regulations

Monitor compliance with posted speed limits, truck legal routes and HAZMAT restrictions to help your drivers avoid traffic infringements.

Fuel card compliance

Track fuel card usage and automatically identify suspicious transactions using smart algorithms that minimise fuel card fraud.

Better driver scores

Using effective training tools and easier compliance management you can help your drivers maintain, and improve, their CSA score.